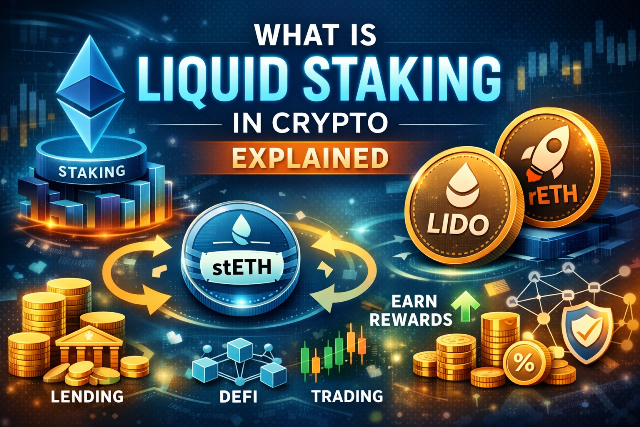

Liquid staking is an innovative concept in the blockchain and DeFi ecosystem that allows users to stake their crypto assets while still maintaining liquidity. This article explains what liquid staking is, how it works, and how popular platforms like Lido and Rocket Pool implement it.

Table of Contents

- What Is Liquid Staking?

- How Does Liquid Staking Work?

- Benefits of Liquid Staking

- Risks of Liquid Staking

- What Is Lido?

- What Is Rocket Pool?

- Lido vs Rocket Pool

- Conclusion

What Is Liquid Staking?

Liquid staking is a staking method that allows users to earn staking rewards without locking up their assets completely. When users stake their tokens, they receive a liquid staking token in return, which represents their staked assets and accumulated rewards.

Unlike traditional staking, where assets are locked and unusable, liquid staking tokens can be traded, lent, or used in DeFi protocols while still earning staking rewards.

How Does Liquid Staking Work?

- User deposits tokens (e.g., ETH) into a liquid staking protocol.

- The protocol stakes the tokens on behalf of the user.

- User receives a liquid token (e.g., stETH or rETH).

- The liquid token increases in value or accrues rewards over time.

Benefits of Liquid Staking

- Earn staking rewards without locking assets

- Use liquid tokens in DeFi (lending, farming, trading)

- Lower entry barriers for staking

- Improved capital efficiency

Risks of Liquid Staking

- Smart contract vulnerabilities

- Protocol centralization risk

- Depegging risk of liquid tokens

- Slashing risks from validators

What Is Lido?

Lido is the largest liquid staking protocol in the crypto ecosystem. It allows users to stake Ethereum (ETH) and receive stETH in return.

stETH represents the user’s staked ETH plus staking rewards. Users can freely trade or use stETH in DeFi platforms while still earning staking yield.

Key Features of Lido

- No minimum ETH requirement

- Highly liquid stETH token

- Widely integrated with DeFi protocols

What Is Rocket Pool?

Rocket Pool is a decentralized Ethereum staking protocol focused on community-run nodes. Users can stake ETH and receive rETH, a token that automatically appreciates in value over time.

Rocket Pool is known for its strong decentralization model and support for small node operators.

Key Features of Rocket Pool

- More decentralized validator network

- Support for permissionless node operators

- rETH increases in value rather than rebasing

Lido vs Rocket Pool

| Feature | Lido | Rocket Pool |

|---|---|---|

| Liquid Token | stETH | rETH |

| Minimum Stake | No minimum | 0.01 ETH |

| Decentralization | Moderate | High |

| Reward Mechanism | Rebasing | Appreciating value |

Conclusion

Liquid staking provides a powerful solution for crypto holders who want to earn staking rewards without sacrificing liquidity. Platforms like Lido and Rocket Pool have become key pillars in Ethereum’s staking ecosystem.

While liquid staking offers flexibility and efficiency, users should always consider the risks involved and choose platforms that align with their decentralization and security preferences.

read more : official Ethereum staking documentation what is staking